We’ve identified accredited Accelerated Finance Degree Online Programs for 2024. Compare schools & accelerated programs.

Finance is a burgeoning field with an expected job market increase of 8% over the next decade (Bureau of Labor Statistics). The employment world of finance is as varied as the ways you earn money.

Editorial Listing ShortCode:

From analysts, managers, and advisors, there is a niche for you if you are ambitious and love numbers and computing figures. After graduation, you may make an average of $72,250 per year (Bureau of Labor Statistics), depending on the career you pursue. Jumpstart your career by earning an online degree in finance as quickly as possible.

Universities Offering Accelerated Online Bachelor’s in Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Bellevue University

Bellevue University is accredited by the Higher Learning Commission.

Cambridge College

Cambridge College is accredited by the New England Commission of Higher Education.

DeSales University

DeSales University is accredited by the Middle States Commission on Higher Education.

Eastern University

Eastern University is accredited by the Middle States Commission on Higher Education.

Purdue University

Purdue University is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

Rasmussen University

Rasmussen University is accredited by the Higher Learning Commission.

Southern New Hampshire University

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

Texas Tech University

Texas Tech University is accredited with the Southern Association of Colleges and Schools Commission on Colleges.

University of Maryland Global Campus

UMGC is accredited by the Middle States Commission on Higher Education.

University of Oklahoma

The University of Oklahoma is accredited by the Higher Learning Commission.

Accelerated Finance Degree Courses

Finance is the cornerstone of most businesses. It makes sense that a finance degree is typically a Bachelor’s of Science in Business Administration with a major in Finance. An online finance degree helps prepare you for both working in business and in finance.

You’ll take classes like:

- Ethics in Contemporary Organizations

- Financial Accounting

- Financial Markets and Institutions

- Managerial Accounting

- Principles of Investments

- Social-Ethical-Regulatory Issues in Business

- Strategic Management

- Supply Chain Management

- Sustainable Enterprise

These classes can help prepare you for a myriad of jobs in the financial sector. You can also take an accelerated finance degree with different concentrations:

- Bachelor’s in Finance – General Finance

- Bachelor’s in Finance – Investments

- Bachelor’s in Finance – Wealth Management

- Bachelor’s in Finance – Real Estate

Your choice of concentration will depend on your career goals.

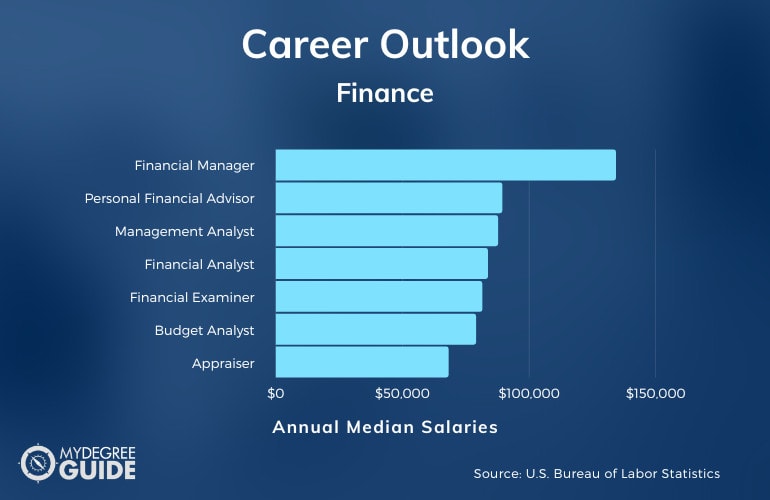

Careers with an Accelerated Finance Degree

The Bureau of Labor Statistics estimates that there will be an additional 750,800 jobs in the next decade in finance and business. The average yearly wage for all those new jobs is estimated at $72,250. That is almost double the average wage of a typical American employee. Some careers in the finance field include:

| Career | Annual Median Salary |

| Financial Manager | $134,180 |

| Personal Financial Advisor | $89,330 |

| Management Analyst | $87,660 |

| Financial Analyst | $83,660 |

| Financial Examiner | $81,430 |

| Budget Analyst | $78,970 |

| Appraiser | $68,130 |

| Purchasing Agent | $66,690 |

| Financial Services Sales Agent | $64,770 |

| Property Appraiser and Assessor | $58,650 |

You might have noticed that a degree in finance holds many similarities to a degree in accounting. So, the question often comes up: What’s the difference between finance and accounting?

In actuality, many of the careers you could pursue would be satisfied with either degree.

A key difference is a degree in Finance will help prepare you for the science of planning and distributing the assets of a business. Accounting is more geared toward the recording and reporting of financial transactions.

Both degrees deal with money, and both have the potential to make you good money. For these reasons, you can be rest assured that finance is a good major along with accounting.

The Advantages of Accelerated Finance Degree Programs

A key skill in the world of finance is good timing when it comes to investments. The same principle applies to starting your degree in finance.

An accelerated online degree in finance may be started at any time of the year. That means that you can choose to start your degree when it works for your life. In a traditional program, you might feel like you are trapped by the September–April schedule. But you don’t have to be.

An online degree offers you the benefit of planning your start for when it works for you, whether that is the middle of the summer or right before Christmas.

Accelerated classes also have a distinct advantage over the traditional classes you could take. They are twice as fast. A typical class will run for a 16 week semester. If you sign up for an online finance class, you may complete the class in 8 weeks.

You may also take another class right after the first and end up with twice as many credits in the same time frame as a regular class. That is a good investment!

How to Accelerate Your Finance Degree Even More

Here are three ways to get your degree as quickly as possible:

1. Take CLEP Tests. Most universities have a Credit by Exam program in place where you may earn 30 credits toward your degree by taking the exams for the classes. If the material is not familiar to you, you can buy a study guide and study for a couple of weeks. When you take the exam, you only have to get 50% of the questions right to receive credit.

2. Take Credit for Your Real-Life Experiences. Do you have experience in the areas of business or finance? You may earn college credit for what you have accomplished at work. This is called Credit for Prior Learning, and most universities have a program in place where your previous life, work, and military experience can be evaluated for credit.

The maximum number of credits that you can typically earn through Credit for Prior Learning is 15.

3. Take the Max Number of Classes. Colleges recommend taking 12-15 credits per semester, but most universities will allow you to take 18 credit hours per semester, including the summer semester. Doing so will help you shave even more time off your degree.

And don’t forget to transfer your credits from previous colleges. As long as the classes you took were from an accredited university and you received a C or better, you might be able to apply those credits toward your degree.

Financial Aid for Finance Students

What is the best way to save money on a finance degree? Answer: take fewer classes. Not only may this save you time, but it may save you a lot of money. The way to take fewer classes is by taking advantage of the College Level Examination Program and submitting a portfolio for Credit for Prior Learning.

Each CLEP test you take costs $89, much less than it would cost to take the class.

To help cover the rest of your tuition, start by filling out the Free Application for Federal Student Aid. You’ll see what grants and loans you qualify for. You can then look for scholarship opportunities from private organizations and universities. If you’re already working, you can ask your employer about tuition assistance programs.

You should always look for financial aid no matter what degree level you pursue, even if it is an online master’s in finance or online PhD in finance.

Finance Degree Accreditation

An accredited degree is a valid degree. Accreditation is not just a fancy designation; it can mean the difference between your future employer recognizing your degree or not.

Most regional colleges will be regionally accredited. That is good enough, but you can also aim for a higher level of accreditation by looking for colleges that have earned accreditation through one of these boards:

- Accreditation Council for Business Schools and Programs (ACBSP)

- Association to Advance Collegiate Schools of Business (AACSB)

- Council for Higher Education Accreditation (CHEA)

Make sure your school has that stamp of accreditation before you start a degree program. You are not saving money or time if your degree ends up being discredited by more reputable universities or employers.

Is a Degree in Finance Worth It?

Yes, a degree in finance is worth it for many students. The Bureau of Labor Statistics is projecting 8% job growth in business and financial occupations over the next 10 years. Common careers in this field include property appraiser and assessor, budget analyst, management analyst, financial advisor, and financial manager.

Start investing your future by narrowing down your choice of schools and researching financial aid opportunities. There’s so much you can do with a degree in finance!

Related Guides: